US group Dell Inc is ramping up its resources to tap into the Chinese server market, as the country’s push for technology-driven growth is fueling a strong demand for internet data centers.

Amid intensifying competition from local rivals, the US tech heavyweight unveiled its latest generation of servers to target Chinese companies which are demanding scalable and automated computing solutions.

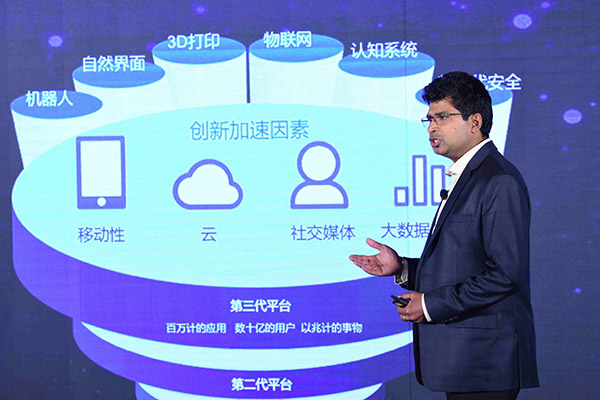

Ravi Pendekanti, senior vice-president of server solutions product management and marketing at Dell, said in Beijing that China is one of the fastest-changing server markets in the world.

Dell sees strong opportunities in China. The government is making a major push into the big data industry, which will spur huge demand for more data-center related solutions, Pendekanti said.

In the first quarter of this year, company revenues in the international server market declined 4.6 percent year-on-year to $11.8 billion, data from the International Data Corp showed. But the China market grew 1.7 percent in Q1, defying the global slowdown.

In the quarter, Dell grabbed the top spot in the China server market in terms of shipments. It accounted for 20.3 percent of almost all the servers shipped in China in the period, compared with its arch rival Inspur Group Co Ltd whose share was 18.1 percent.

Dell said it is seeing strong demand from web companies, State-owned enterprises, as well as the manufacturing, healthcare, education and other sectors in China.

In a move to better serve Chinese companies, Dell unveiled its 14th Generation of PowerEdge servers on Wednesday, nearly three years after the launch of its 13th Generation PowerEdge server portfolio.

The upgraded PowerEdge servers, which run on Intel’s latest Xeon Scalable Family processors, can more efficiently drive corporate data centers and address specified workloads of different companies, Pendekanti said, adding that his company was adding more intelligent automation capabilities to its servers.

As China pushes forward with its Belt and Road Initiative, Dell also sees big opportunities in helping Chinese companies set up overseas data centers.

“It is a unique advantage of Dell being a multinational company with global operations in almost every country and every region,” Pendekanti said.

“We can help Chinese companies get to know the regulations in different countries better and help them leverage more local resources.”

Fu Liang, an independent server expert, said Dell has managed fast growth in the server market, with an edge in shipments, but more effort was needed to expand its presence in the high-end segment in China.